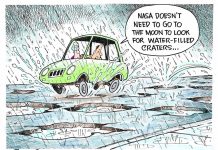

Indiana lawmakers are faced with an important but difficult decision that taxpayers are keeping a close eye on: how to fund the ongoing maintenance and improvements to the state’s infrastructure of highways and roads.

This is an issue the state has faced for years without coming up with a long-term solution. The financial bonanza that once was Major Moves funding resulting from the state leasing the Indiana Toll Road is past.

What’s on the table now are ideas such as increasing the fuel tax, using money from the state’s General Fund, increasing the excise tax and creating more toll roads throughout the state. No one idea is an overwhelming slam dunk, which makes the decision difficult.

However, the idea of using General Fund money raises the concern about creating a robbing-Peter-to-pay-Paul scenario. Taking money from another need, like education, for example, to pay for roads would address one problem while creating another.

Creating more toll roads would produce more revenue, but only the users of those toll roads would be paying. Raising the excise tax would generate extra revenue, but just from Hoosier motorists.

A fuel tax has the greatest potential as a user fee for those traveling on roads, applying not only to Indiana residents but also out-of-state visitors.

Indiana has not increased its gas tax in 14 years. Many residents, naturally, don’t want to see any tax increase enacted, and that’s understandable. But finding a way to fund needed road improvements without raising taxes and not creating additional problems with funding other needs is a monumental challenge and one that is unlikely long-term.

What makes sense is that those who use roads should help pay for their maintenance and improvement. Increasing the fuel tax would be a sensible way to do that — just like it makes sense for counties to enact a wheel tax to pay for improvements to local roads.

If lawmakers opt to enact a fuel tax increase or some other revenue-generating measure to fund road repairs, it’s important that all that revenue go for such a purpose. A Senate version of the fuel tax increase would allow some of the additional revenue to pay for increases for state troopers. That’s not a wise idea.

Doing so would siphon needed money for road repairs and likely would cause mixed feelings from taxpayers about the true purpose of the tax increase.

Any additional revenue from a fuel tax increase must go entirely toward road repairs. Raises for state troopers — or any similar suggestions — needs to find support another way.