This editorial was written by the (Fort Wayne) Journal Gazette.

The battle to curb short-term, high-interest "payday" loans in Indiana took on new urgency recently.

Though efforts to draw lawmakers’ attention to a lending system that preys on struggling Hoosier families have repeatedly failed in past sessions, consumer advocates had hope that pending federal regulations initiated during the Obama administration would at least mitigate some of the damage. The federal rules, which had been scheduled to take effect last year, would among other things have required payday lenders in states such as Indiana to at least determine whether borrowers had the means to repay their loans without falling even further behind.

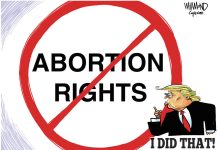

But in the Trump administration, the U.S. Consumer Financial Protection Bureau has taken a very different turn.

The bureau first delayed implementation of the rule for a year. On Feb. 6, Director Kathy Kraninger said the bureau wants to kill the means-test requirement and once again delay putting the rest of the rule into effect.

With no help on the horizon from Washington, D.C., the state’s coalition of veterans’ advocates, religious groups and consumer and social-service organizations needs to fight even harder to persuade legislators to end predatory lending.

For several years, payday-loan opponents have mainly been playing defense, beating back attempts to expand the system that now allows two-week loans at the equivalent of 391 percent annual interest.

The argument for such outlandish rates is that the loans help families cope with sudden unexpected expenses. But too often, such loans only drive families deeper into debt, as they take out subsequent loans to pay off their original one.

"Payday borrowers are more likely to experience delinquencies on other bills, (involuntary) bank account closures, delayed medical care, and bankruptcy," Erin Macey of the Indiana Institute for Working Families, said in a release Feb. 7, "and they often turn to the very sources they could have used to avoid payday loan debt only after digging a much deeper hole."

Last month, Senate Bill 104, which would cap short-term loans at the equivalent of 36-percent annual interest, was the subject of testimony in the Senate Insurance and Financial Institutions Committee – the first time an anti-payday-loan bill has ever been heard in committee, according to Macey.

Whether the bill goes any further this year may be up to committee chairman Sen. Eric Bassler, R-Washington, who must decide whether to call SB 104 for a vote before (today’s) deadline for bills being reported out of committee. Washington, D.C.’s, failure to take action on predatory lending makes Indianapolis’ need to do so even more urgent.