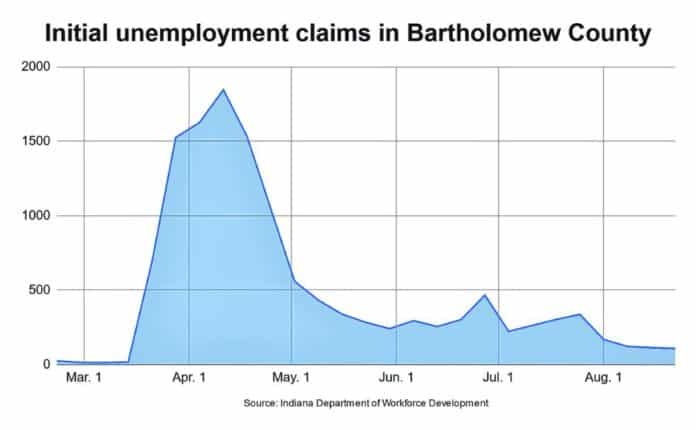

Jobless claims in Bartholomew County dropped slightly, mirroring similar declines seen statewide and national and continuing a general downward trend in the county since mid-April, according to the latest state figures.

A total of 108 initial unemployment claims were filed in Bartholomew County the week ending Aug. 22, down from 114 the week before and 1,845 the week ending April 11, according to the Indiana Department of Workforce Development.

Additionally, a total of 1,452 Bartholomew County workers were drawing jobless benefits the week ending Aug. 15, down from an adjusted 1,609 the week before and 5,039 the week ending May 2.

In Indiana, 10,778 people sought jobless aid the week ending Aug. 22, down from 11,569 the previous week. A total of 1,006,000 workers filed initial unemployment claims across the country, down 98,000 from the 1.1 million who filed a week before.

[sc:text-divider text-divider-title=”Story continues below gallery” ]

Despite the drop, claims still remain high.

By comparison, the average number of initial jobless claims in Bartholomew County from January 2010 to January 2020 was around 39, while the average number of continued claims was 434 over the same time period, according to state figures. Last year, those figures had dropped to 20 and 127, respectively. U.S. consumers increased their spending by 1.9% last month, a dose of support for an economy struggling to emerge from the grip of a pandemic that has held back a recovery and kept roughly 27 million people jobless.

Before the pandemic, the number of initial unemployment claims in the U.S. had never surpassed 700,000 in a week, according to the Indianapolis Business Journal.

The latest round of jobless data came as U.S. Commerce Department announced that consumer spending, the primary driver of the U.S. economy, increased for the third straight month, but represented a slowdown from the previous two months, The Associated Press reported.

Friday’s report from the Commerce Department also showed that income rose 0.4% in July after two months of declines.

The consumer spending report arrives amid a hazy economic landscape, with high unemployment, struggling businesses and deep uncertainty about when the COVID-19 health crisis will be solved and when people and companies will feel confident enough to spend and hire normally again, according to wire reports. It also comes weeks after the expiration of a $600-a-week federal unemployment benefit deprived millions of a key source of income and dimmed the outlook for consumer spending.

The economy, after a catastrophic fall in the April-June quarter, is likely expanding again, according to wire reports. Home and auto sales have been strong. Stock prices have set record highs.

A persistently high level of confirmed viral cases has damaged several industries, especially those involved with travel, tourism and entertainment, and is holding back growth. On Thursday, the government reported that roughly 1 million people applied for unemployment benefits last week — a historically high level that has prevailed for weeks.

The Conference Board, a business research group, reported this week that consumer confidence has tumbled to its lowest level since 2014, according to wire reports. And in survey results released this week by the National Association for Business Economics, two-thirds of economists who were polled said they thought the economy remains in recession. Nearly half said they didn’t expect it to return to pre-pandemic levels until mid-2022.

After enacting a massive financial rescue package in March, congressional Republicans and Democrats have failed to agree on allocating more aid to the unemployed and to struggling states and localities, according to The Associated Press. The expiration of the $600-a-week federal jobless benefit is leaving some families desperate. Economists say the loss of that aid has also deprived the economy of a key pool of spending money.

President Donald Trump signed an executive order Aug. 8 offering a stripped-down version of the expanded unemployment benefit. At least 39 states have accepted or said that they would apply for federal grants that let them increase weekly benefits by $300 or $400. But it’s unclear how soon that money will actually get to people or how long it will last.