By Bud Herron

My wife and I must admit we can be spendthrifts at times.

Over the past three or four years of coping with life’s problems, we have spent a lot of money we really didn’t have. We couldn’t help it. We needed all that stuff.

We have not been worried about our spending because we have a great credit rating. When we want or need something, we simply put it on our charge cards, or take out a bank loan or negotiate an IOU with friends and relatives.

The system works. When we are asked to pay back some of the money, we just borrow more money for the payment.

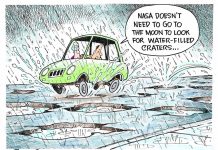

Occasionally, however, we get concerned about how our spending looks to budget-obsessed acquaintances and decide to try to regulate ourselves a bit. A few years ago, in an effort to keep our finances in line, we agreed to impose an annual debt ceiling on ourselves.

In retrospect, we think this was a great idea.

Our family debt ceiling works because it does not require us to quit taking out loans, filling up charge cards or borrowing money on IOUs from friends and family members. It simply sets a limit on how much money we can use to pay back the debts on the things we purchased in the past.

Now, is that GREAT or what?

I recently took out a loan with a Chinese pay-day lender on the internet to buy a new Lamborghini automobile. It cost $208,571, but I needed it. (They gave me 100 percent financing and free oil changes for a year.)

Then my wife had a conscience attack over what she saw as my self-indulgence in the face of world hunger. So, she went online to Amazon and charged 500,000 cases of mac & cheese to be shipped to some country I cannot pronounce, even if I could remember where it is.

But, I digress.

These purchases didn’t matter because we haven’t been billed for them yet. The debt ceiling my wife and I agreed to only applies to things we bought last year or earlier — things we mostly already ate or drove or broke or lost or otherwise used up.

Now, the people who lent us money have sent a due-upon-receipt bill, demanding not only the amount of money we borrowed but a huge amount of interest.

Well, pooh on them. We have a debt ceiling.

Our family’s debt ceiling retroactively controls what we already have spent, making sure we do not meet more of our financial obligations than our monthly Social Security income can afford.

But pesky creditors are now demanding payments, threatening to cut off our credit or even repossess the three-month vacation we had last year on the French Riviera. (That trip was much needed to get over the trauma of living with the pandemic.)

My wife and I are honest people and would like to raise our family debt ceiling to solve the problem, but we can’t agree on which one of us should accept the blame for the Lamborghini and the mac & cheese.

While we know those new expenses have nothing to do with our current debt ceiling, most of our neighbors have no idea how our debt ceiling works. Most think it has to do with the car and the food shipment we put on next year’s bills.

Therefore, we fear that raising the ceiling and paying off old debts will look bad to friends and neighbors. Neither one of us wants to take the blame, in case we decide to run against each other for county treasurer in 2022.

So, as an interim measure, we plan to raise our debt ceiling just enough to keep the creditors happy until December. Then, we can negotiate again in time for Christmas shopping.

Bud Herron is a retired editor and newspaper publisher who lives in Columbus. He served as publisher of The Republic from 1998 to 2007. Contact him at [email protected].