The New York Times

Jerome Powell, the chair of the Federal Reserve, has often expressed admiration for the resolve exhibited by one of his predecessors, Paul Volcker, who was willing to crash the economy in the early 1980s to drive down inflation.

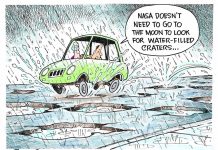

Inflation in the United States is now higher than at any time since Mr. Volcker’s recession, and Mr. Powell faces growing calls for the Fed to emulate that resolute performance and do whatever is necessary to control inflation, even if it hurts economic growth.

The present moment requires a different kind of courage. Instead of reprising Mr. Volcker’s shock-and-awe tactics.

It is time to raise rates. The economy has rebounded as COVID-19 has loosened its grip. Inflation is now the primary economic problem confronting the United States. Prices are outpacing wage growth for most Americans, eroding their living standards, and higher rates will help to slow rising prices.

The Fed’s benchmark rate would need to rise to somewhere between 2% and 3% to reach a level at which it is neither stimulating nor restraining growth. Some Fed officials and outside economists have argued for additional half-point moves in the coming months. Some already are convinced the Fed will need to raise rates well above that neutral level to break inflation. Under Mr. Volcker, the rate hit 20%. Mr. Powell, to his credit, has maintained a more measured tone. He said recently it was time for the Fed to move “a little more quickly.”

One reason to go slowly is that it takes time to judge the impact of changes in Fed policy. Merely by signaling that it plans to raise rates, the Fed already has initiated a significant reaction in financial markets. Average interest rates on home mortgages, for example, have climbed sharply. The monthly mortgage payment required to buy a median-price home has increased to $1,690 from less than $1,165 a year ago, according to Roberto Perli, the head of global policy research at the investment bank Piper Sandler.

In the 1970s, workers successfully demanded wage increases to compensate for expected increases in prices, while employers raised prices to cover the expected cost of higher wages. This dynamic, which economists call a wage-price spiral, can be dangerously self-perpetuating.

But in the intervening decades, American workers have suffered a significant loss in bargaining power. While many businesses say they are struggling to find enough workers, that has not translated into real wage gains for employees. Businesses are raising prices much faster than they are raising wages, allowing them to reap record profits. While inflation is up by 8.5% over the past year, wages for private-sector workers are up by just 5%. In other words, there is no evidence the United States is entering a wage-price spiral.

Finally, Mr. Powell can afford to move more cautiously because Mr. Volcker and his successors convinced the American public and global investors that the Fed is committed to controlling inflation.

Mr. Volcker once told an interviewer that he wore a path in his rug by pacing back and forth, wondering whether the pain he was imposing would accomplish that goal. It was a victory won at a high cost. Moving too quickly to confront inflation, or raising rates too high, would squander it.