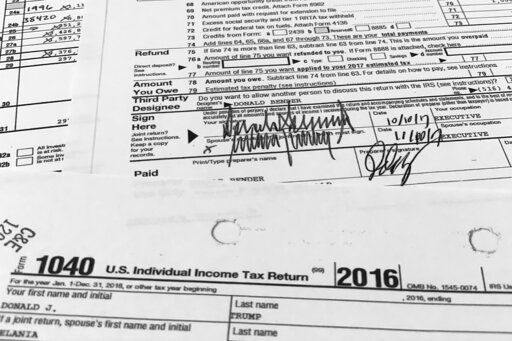

Democrats in Congress released thousands of pages of former President Donald Trump’s tax returns on Friday, providing the most detailed picture to date of his finances over a six-year period, including his time in the White House, when he fought to keep the information private in a break with decades of precedent.

The documents include individual returns from Trump and his wife, Melania, along with Trump’s business entities from 2015-2020. They show how Trump used the tax code to lower his tax obligation and reveal details about foreign accounts, charitable contributions and the performance of some of his highest-profile business ventures, which had largely remained shielded from public scrutiny.

The disclosure marks the culmination of a yearslong legal fight that has played out everywhere from the presidential campaign to Congress and the Supreme Court as Trump persistently rejected efforts to share details about his financial history — counter to the practice of transparency followed by all his predecessors in the post-Watergate era. The records release comes just days before Republicans retake control of the House and weeks after Trump began another campaign for the White House.

Trump, according to the filings, reported having bank accounts in China, Ireland and the United Kingdom in 2015 through 2017, even as he was commander in chief. Starting in 2018, however, he only reported an account in the U.K. The returns also show that Trump claimed foreign tax credits for taxes he paid on various business ventures around the world, including licensing arrangements for use of his name on development projects and his golf courses in Scotland and Ireland.

Trump paid $641,931 in federal income taxes in 2015, the year he began his campaign for president, according to a report released last week by Congress’ nonpartisan Joint Committee on Taxation. He paid $750 in 2016 and 2017, nearly $1 million in 2018, $133,445 in 2019 and nothing in 2020, the year he unsuccessfully sought reelection.

The documents show that Trump’s charitable donations fluctuated during his presidency but, in his final years, represented only a sliver of his income. In 2020, Trump reported no charitable donations at all. In 2019 and 2018 he reported writing checks for about $500,000 in donations. In earlier years the numbers were higher — $1.8 million in 2017 and $1.1 million in 2016.

It’s unclear whether the reported sums included Trump’s $400,000 annual presidential salary, which he had said he would forgo and said he had donated to various federal departments.