COLUMBUS, Ind. — Talk of instituting a wheel tax in Bartholomew County has surfaced again, as some local officials say they think state lawmakers want all Indiana counties, including Bartholomew, to enact the tax.

Bartholomew County commissioner Tony London told legislators Monday he was not happy with Senate Bill 207, which passed out of the Senate Appropriations Committee this week. If approved, the legislation will reduce a county’s required amount of motor vehicle highway monies that must be spent exclusively for road construction, reconstruction, and preservation by 10%. However, counties will only be given that financial flexibility if they pass a wheel tax.

A wheel tax is an additional tax on motor vehicles in a county, ranging from $20 to $40, or more for trucks, allowing counties to recoup costs associated with maintaining roads. Bartholomew County does not have the tax, but it has been debated extensively over the years.

For about 15 years, nearly every statehouse proposal that would give counties more financial control with highway distribution funds starts out with a demand the county institute a wheel tax, county highway engineer Danny Hollander said.

“The state lawmakers don’t want to take all the political heat for passing the gas tax,” said Hollander, referring to the 10-cent a gallon tax increase approved in 2017. “They want locals to take some heat, too, and they are just trying to force us into finding other means of revenue.”

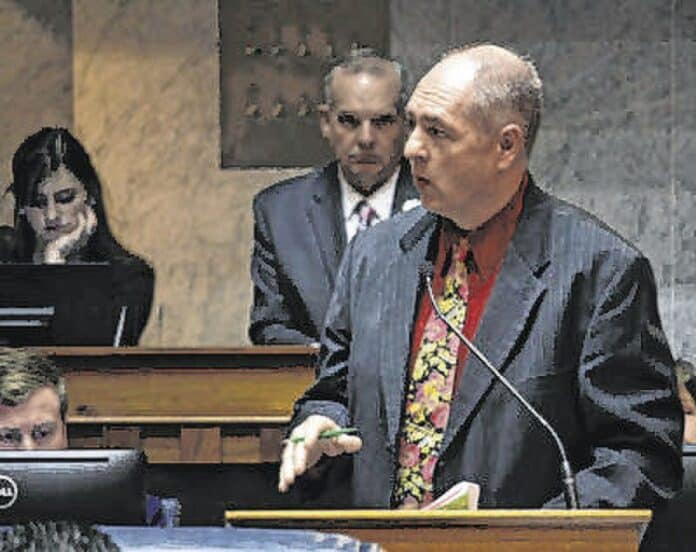

London asked two state lawmakers if there’s an effort underway at the statehouse to punish counties that don’t enact a wheel tax.

In response, Sen. Greg Walker, R-Columbus, said there has long been a belief among Indiana lawmakers that if towns, cities and counties want more flexibility in their spending, they should raise additional revenue on their own.

The Indiana Department of Transportation (INDOT) has an extensive number of interstates and highways to maintain, so available funds must be viewed as a shared revenue and a shared distribution, Walker said. INDOT also continues to have two rounds of Community Crossings matching grant distributions annually, he said. That program currently provide about a third of all local road funding, Rep. Ryan Lauer, R-Columbus, said.

“These provisions are meant to press everyone at the state and local level to have ‘skin in the game’ when it comes to how much funding is available for local roads,” Walker said.

Originally coined by investor Warren Buffett to reference to taking risks to achieve goals, the term “skin in the game” didn’t sit well with Hollander and other Bartholomew County officials.

“I don’t think Sen. Walker understands there are other opportunities for ‘skin in the game’ than a wheel tax,” Hollander said.

Just three months after the state increased the gas tax in July 2017, the Bartholomew County Council did take a political risk by approving a 40% increase in the county’s local income tax.

In addition, the commissioners have given the highway department some of their own local income tax revenue to pay for necessary expenses, Hollander said. In addition, Bartholomew County has one of the smallest highway departments in the state, and occasionally does road projects themselves without hiring outside contractors, the engineer said.

“I don’t see there is much interest in Bartholomew County to institute a wheel tax, nor do we need a wheel tax because of the good fiscal responsibility we have followed,” London said.

But without more flexibility to control how highway monies from the state are spent, it will be difficult to balance budgets, commissioner chairman Larry Kleinhenz said.

In addition, the local share of highway distribution money from the state keeps going down a little bit every year, Hollander said.

While more than 50% of that money used to be invested into local roads, the distribution has flipped a bit in recent years, Lauer said. Now, about 55% goes to the state while 45% goes to local government entities, he added.

Meanwhile, the highway department’s costs for non-road related expenses as insurance, the replacement of heavy-duty machinery and repairs keeps going up, Hollander said.

“It causes problems because when all the costs go up, funding also has to go up,” London said. “So we’re struggling to pay our people in the highway department.”

In addition, there is a general consensus that the cost of basic materials including tar, aluminum and asphalt have kept rising as well.

London said he got a sense that Lauer, who served on the Bartholomew County Council from 2010-2014, agrees with the commissioners on the need for better local financial flexibility without a wheel tax.

“I’m generally against tying those kind of funding carrots to whether you have the wheel tax or not,” Lauer said. “Those bills usually come from areas that already have wheel taxes, and I’d like to see a greater percentage of the dollars go into our local communities.”

SB 207 is authored by three Republican senators who are all from communities near South Bend: Blake Doriot of Middlebury, Ryan Mishler of Bremen and Linda Rogers of Granger.

Walker did express a willingness to remain flexible on the matter. The senator said he’d like to examine all factors that go into the highway funding formula with the commissioners and the highway department to see if any changes are warranted.