From: Caleb Tennis

Columbus

As I finish writing my final 2017 quarterly tax checks, I’m reminded that in 2018 the local government will be taking a larger bite, thanks to the county council’s decision to implement a 40 percent local tax increase. With median household income at $55,000, an additional $275 per year in local taxes will now be paid per typical family.

To those who live paycheck to paycheck, it’s anything but trivial. The average family has less than $1,000 in savings, meaning they’re just a car problem or furnace breakdown away from financial ruin. This tax increase isn’t going to help.

All of the involved elected officials and government employees supporting this increase received raises this year. That’s not a bad thing in and of itself. But, it’s a telling sign that just about everyone who championed the tax increase is completely insulated from its direct effects.

Indirectly, though, this tax increase will have further reaching impacts. A few fortunate workers may get raises from their employers to compensate, but most will not. This ultimately translates into higher costs passed on to consumers. Prices will go up for everybody. The $11 million in new revenue this brings into the city and county’s coffers doesn’t magically appear from nowhere; it comes straight out of the local economy.

In Jennings county, with a local tax rate already significantly higher than Bartholomew county, the commissioners took a different approach — they’re suing the pharmaceutical manufacturers directly. It’s a controversial tactic for sure. But think about the message it sends: it places the financial burden of treatment directly on those who are profiting off of the sale of the opioids. It’s a more creative attempt at a solution rather than just raising taxes even higher.

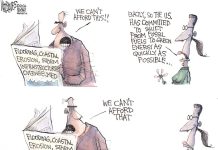

I’m glad our elected officials want to tackle tough problems. Who can argue we don’t need to invest in public safety and addiction treatment? When this crisis is over, though, will tax rates be reduced? Of course not. Once we no longer have a dire need in one area it materializes elsewhere. Bridges, roads, schools, utilities, health care — there’s no shortage of a need for taxes.

The 2015 county budget was $17 million, this year’s budget is nearly $24 million. The city’s 2015 budget was $50 million, and for 2018 it’s $58 million. The two combined represent over a 20 percent increase in just three years. These numbers don’t even include the $11 million in new income tax revenues for 2018.

It seems to me that the real local crisis isn’t opiate addiction, it’s our elected officials’ unwillingness to tackle massively growing budgets and the rampant spending that follows.