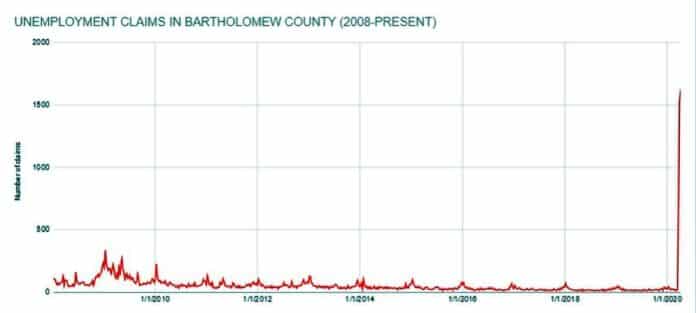

Bartholomew County unemployment claims continued to surge for the third consecutive week as companies running through their cash cushions during pandemic-related shutdowns resort to layoffs to save money.

Last week, 1,625 initial unemployment claims were filed in Bartholomew County — the highest one-week total in the county since at least before 2008, according to Indiana Department of Workforce Development figures. There were 789 claims in the manufacturing sector, 130 in retail and 117 in the accommodation and restaurant industry.

A total of 3,840 unemployment claims have been filed in the county over the past three weeks on record, more than all claims filed every week since January 2017 combined. Before last month, the highest number of claims filed in a week during the past 12 years was 336 during the week of Jan. 10, 2009, according to state figures.

The last three weekly jobless reports for Bartholomew County show a total of 1,596 claims filed in the manufacturing sector, 221 in retail and 600 in the accommodation and restaurant industry.

A staggering 16.8 million Americans have lost their jobs in just three weeks in a measure of how fast the coronavirus has brought world economies to their knees, The Associated Press reported.

In Indiana, 282,567 initial unemployment claims were filed over the past three weeks on record, including 108,628 filed last week, the latest data available, according to state figures.

“During the month of March, the weekly number of unemployment insurance claims pretty much shattered everything that we had seen before,” said Fred Payne, commissioner of the Indiana Department of Workforce Development. “For the week ending April 4, we didn’t much different. …This was down a little bit from the previous week but it still posts the second-highest number of weekly claims filed in Indiana history.

The Indiana Department of Workforce Development has made 175,195 payments for unemployment claims so far this month, according to state figures. By comparison, the state made 71,000 payments during the entire month of April 2019.

Payne acknowledged that there have been complaints about wait times when calling in and calls being dropped when they are transferred, adding that his IT team is attempting to address the issue.

“We continue to have a high call volume that is associated with our high claims volume,” he said. “We are having some technical difficulties that we’re working on this week. We started with a new contractor and we’re working out all of the kinks in that. But we have had some complaints, or some concerns, about calls being transferred, and when they’re transferred, they end up getting dropped. We’re working with our IT team to make sure that issue is being addressed.”

Up to 50 million jobs are vulnerable to coronavirus-related layoffs, economists say — about one-third of all the jobs in the United States, according to wire reports. That figure is based on a calculation of positions that are deemed non-essential by state and federal governments and that cannot be done from home. It’s unlikely all those workers will be laid off or file a jobless claim. But it suggests the extraordinary magnitude of unemployment that could result from the pandemic.

Beth Ann Bovino, chief economist at S&P Global Ratings, told The Associated Press that she thinks layoffs will send the unemployment rate to 15% next month, with at least 13 million jobs lost. Consider that during the Great Recession, which ended in 2009, unemployment never went above 10%.

“It’s unbelievable that I am saying this,” Bovino said. “It’s mind-boggling.”

Even with applications for unemployment aid surging, some of the newly jobless are running into trouble applying for benefits, according to The Associated Press. The federal government’s $2.2 trillion economic relief package expands unemployment insurance to groups that previously weren’t eligible, including the self-employed, gig workers, and independent contractors. Yet many states haven’t updated their websites to reflect the new rules.

Currently, self-employed and independent contractors have been getting denied unemployment benefits in Indiana because the state’s system does not yet recognize that classification of worker, Payne said.

“For the independent contractors, for those who are self-employed, as a reminder, our system was not currently designed to address these claimants,” Payne said. “This is an entirely new classification of workers that will be paid unemployment compensation benefits. As we build out our new system, we’re looking at a variety of things and we’re working across different state agencies. …We’re working on that system, and once that system is in place, it will recognize you as a beneficiary and you will start receiving payments.”

The data on the U.S. economy is also bleak, according to wire reports. With the vast majority of the country enduring business shutdowns, economic activity has slowed to a near-halt. Janet Yellen, the former chair of the Federal Reserve, said Monday that the economy would likely shrink at a 30% annual rate in the April-June quarter — a contraction that would be unmatched in records dating to World War II.

“This is a huge, unprecedented, devastating hit,” Yellen said.

[sc:pullout-title pullout-title=”How to file” ][sc:pullout-text-begin]

Visit www.in.gov/dwd/2362.htm for more information on how to file an unemployment claim.

[sc:pullout-text-end]