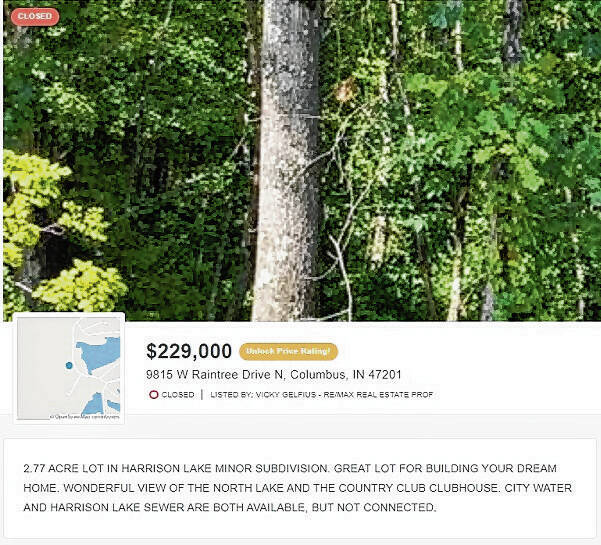

This image from a 2021 online real estate listing shows a property near Harrison Lake owned by mayoral candidate Milo Smith that was listed for sale at a price of $229,000. Months earlier, Smith successfully petitioned the county to reduce the property’s assessed value to $300.

A candidate for the Republican nomination for Columbus mayor has confirmed he received nearly a full tax assessment reduction two years ago on property he owns overlooking Harrison Lake west of Columbus, according to county tax records.

Milo Smith, who is seeking the GOP nomination in a race against Mary Ferdon, executive director of administration and Community Development for the city of Columbus, received a 99.7% tax assessment reduction two years ago on a 2.77-acre property he owns on Columbus’ west side, according to county tax records.

After the reassessment, Smith’s annual county property tax bill for the vacant wooded property at 9815 W. Raintree North Drive, overlooking a community of $1 million homes, was $5 for taxes payable in 2022. Before the reassessment, the tax bill had been $1,648.

The reduction came after Smith appealed the assessed value of his property, which for several years had been $97,300. After Smith appealed, the Bartholomew County Property Tax Assessment Board of Appeals (PTABOA) reduced the assessed value of the property to just $300.

Smith defended the reassessment in a telephone interview, saying his property was reassessed to reflect the value that would be applied to any similar agricultural property.

“… Assessments in the state of Indiana are based on market value in use and current use, and my current use is growing timber. It has no other purpose,” Smith said of the property. “It has no purpose to me whatsoever right now except to someday harvest trees off of it.”

That’s what Smith told the board when he appealed his assessment in early 2021. After a hearing on March 30, 2021, the board — comprised of nonvoting member Bartholomew County Assessor Ginny Whipple and voting members Todd Boilanger, Barb Dunlap and Mary Rigsby — unanimously approved the reassessment by agreeing to reclassify Smith’s lakeview property as agricultural woodland property.

Yet shortly after the reassessment, Smith listed the same property for sale, advertising a far different use than harvesting timber: “Great lot for building your dream home,” the real estate multiple listing service advertisement for the property said. “Wonderful view of the north lake and the country club clubhouse.”

According to a closed listing that remained online this week, the property was listed at $229,000 last September.

“I think a lot of farmers would sell their agricultural land if the price is right,” Smith said of the listing, adding that he didn’t write the property description in the ad. He noted the property is not in Harrison Lake subdivision and has no lake access. He also said the property is no longer actively listed for sale. “There is no current listing with the property right now that I’m aware of.”

Smith has been running an ad indicating that those “tired” of increasing taxes should vote for him. Ferdon said she had no knowledge of the reassessment and declined to comment.

A longtime accountant, tax consultant and formerly a member of the Indiana General Assembly from 2006 to 2018, Smith, 72, is well acquainted with Indiana’s property tax laws, its appeals systems and the local property tax board of appeals. In fact, Smith went before the local board to appeal the assessed value of this same property in 2019.

That year, however, the outcome was different.

The board rejected Smith’s appeal, and the assessed value remained unchanged at $97,300. Smith then appealed to the Indiana Board of Tax Review in Indianapolis.

On Sept. 17, 2020, administrative law judge Jennifer Thuma held a telephone hearing on Smith’s appeal. Smith testified that his property should be reclassified and assessed as agricultural land used to grow and harvest timber. Whipple, the county assessor, argued that the property should remain classified as residential, as it had been for more than 70 years, and should remain assessed at $97,300.

On Dec. 15, 2020, Thuma issued the Indiana Board of Tax Review’s final determination, rejecting Smith’s appeal.

“Because the Smiths failed to show the subject property was devoted to agricultural use, the Board finds for the Assessor and orders no change to the subject property’s 2019 assessment,” the state ruled.

In reaching this conclusion, the administrative law judge looked to state tax law in similar cases, past use of the Smiths’ property, and weighed sworn evidence presented by Smith and Whipple.

“The Assessor contended that the Smiths did not meet their burden of proof to demonstrate that the parcel is used for agricultural purposes,” the administrative law judge wrote. “The property was classified as residential prior to the Smiths’ purchase in 2011 and has been part of the residential subdivision since the developer first created it in 1949. When the Smiths bought the land, they intended to build a house. The land continued to be assessed as residential prior to their purchase, and after they purchased it.”

Based on the assessor’s arguments that the state upheld, Thuma wrote, “Unimproved, vacant lots are assessed at $35,000 per acre and this is the assessment for the Smiths’ parcel lot per acre. The assessment is consistent with other unimproved lots in the same subdivision.”

In weighing Smith’s arguments, Thuma found, “Mr. Smith testified that he contacted a forester to inquire about growing timber. He also stated that further development of the subject property would be costly or nearly impossible. But he did not say that he had no intention of ever building a home on the subject property. It is possible for a property to have more than one use. For instance, a property could be used for timber growth while simultaneously being held for future development.

“But the law requires that a property be devoted to agricultural use to receive the agricultural rate,” Thuma found. “We are not convinced that the Smiths have entirely abandoned their original intent of building a home on the subject property. In addition, Ind. Code § 6-1.1-4-13 (d), the statute that provides the agricultural rate for timber harvesting, states that land is not devoted to agricultural use when it is purchased for industrial, commercial, or residential use. And the Smiths admitted to purchasing the property for residential use. Under these circumstances we cannot conclude that the subject property is devoted to agricultural use.”

Yet four months after that determination, Whipple’s position — and that of the local appeals board, and thus Smith’s assessed valuation — changed.

At its March 30, 2021, Smith was back before the board again appealing the assessed value on the same property, using the same argument.

According to the minutes of that meeting:

“Mr. Smith state his intend (sic) for this parcel is to promote the growth of hardwood timber for future harvest. He request (sic) the property be changed to agricultural use and the land be changed to woodland.

“Assessor Whipple stated that if his intent is to grow and sell hardwood timber, with the letter from (consultant forester Clark Fleming) she would agree to Mr. Smith’s request.

“Mary Rigsby made a motion to change this parcel to agricultural use and land to woodland. Barb Dunalp (sic) seconded that motion, which passed unanimously.”

On April 14, 2021, the board filed its final assessment determination, as required by law, and justified the reassessment by saying only, “Petitioner submitted a land management plan.”

When asked for a copy of that plan, Whipple replied that there was no actual land management plan. Instead, she forwarded the one-page letter that Smith had submitted from Fleming that included observations about the trees on the property, soil conditions and general recommendations to promote potential future timber harvests.

“Considering the poor soil fertility on this property, it may take several more years,” before maple trees on the property reached a size suitable for harvest, the letter from Fleming to Smith said. He signed the letter, “Good luck with your project.”

For his part, Smith said the property should have been considered agricultural all along. “I am farming this site,” he said. “I have gone in and cleaned up debris and briars and things like that … so that the trees wouldn’t have vines and stuff on them that would hurt them, and I’ll continue to do that.”

Whipple defended the reassessment, explaining that changes in property tax law since 2014 have allowed smaller parcels of land such as the Smith property to be reclassified as agricultural. She said the base rate for assessing Smith’s property as agricultural woodland is around $645 an acre, but productivity factors and soil quality further reduce the value, which is how the PTABOA arrived at the $300 assessed value. She noted Smith’s assessed value is negatively impacted by poor soil condition factors as determined by Purdue University.

“It’s Indiana law,” Whipple said. “We have to follow the codes and the statutes, and there are lot of things that are not fair about it.” Smith’s reassessment, she said, “follows the law, and from that perspective, it’s fair. He’s treated just like any other taxpayer” appealing an assessment.

Yet Smith’s assessed value is the lowest even among comparable properties in the county that Whipple produced when requested by The Republic. Searching property records for comparable wooded agricultural properties roughly the same size as Smith and assessed using the same methodology, she produced three:

- A 2.24-acre property in Harrison Township had an assessed value of $400.

- A 2.82-acre property in Columbus Township had an assessed value of $600.

- A 2.55-acre property in Clay Township had an assessed value of $600.

Meanwhile, adjacent to Smith’s property is a 1.96-acre wooded property. Its assessed value is $108,000, according to county tax records. However, that property is exempt from taxes because it is development-restricted conservation property held by Sycamore Land Trust.

At the March 30, 2021 meeting where Smith’s reassessment was approved, the local appeals board heard 17 new property tax appeals. Smith’s was one of only three appeal requests the board approved and assessed at a reduced value. Six other appeals were denied, and eight were tabled for future meetings.

Of the 17 appeals heard that day, according the the board’s minutes, Smith spoke for 16 of the taxpayers; one represented himself. The appeals Smith appeared for ranged from individual taxpayers to some of the county’s largest employers.

Smith has owned Tax Consultants Inc. of Columbus since 1968. Tax Consultants Inc. represents the vast majority of taxpayers who are represented at appeals hearings, Whipple said.

Recently, Smith’s daughter, Tax Consultants attorney Melissa Michie, has appeared for the firm’s represented taxpayers at hearings before the board, Whipple said.

Smith did appear before the appeals board on Jan. 24 of this year, Whipple said, to represent Tax Consultants clients, because his daughter was stuck in traffic. Smith had filed to run for Columbus mayor not quite three weeks earlier.

Asked if he was concerned some people might perceive he received preferential treatment in his reassessment appeal, Smith said, “I don’t know why they would feel that way.”