Economic output in Indiana, the nation and Columbus is expected to grow at a slower pace in 2020, as companies and consumers grapple with the fallout and uncertainty of global trade friction and a projected U.S. manufacturing slowdown.

“We think that the key risk in 2020 is the risk of a further rise in protectionism and trade wars,” said Ellie Mafi-Kreft, a clinical associate professor of business economics and public policy at the Kelley School of Business at Indiana University.

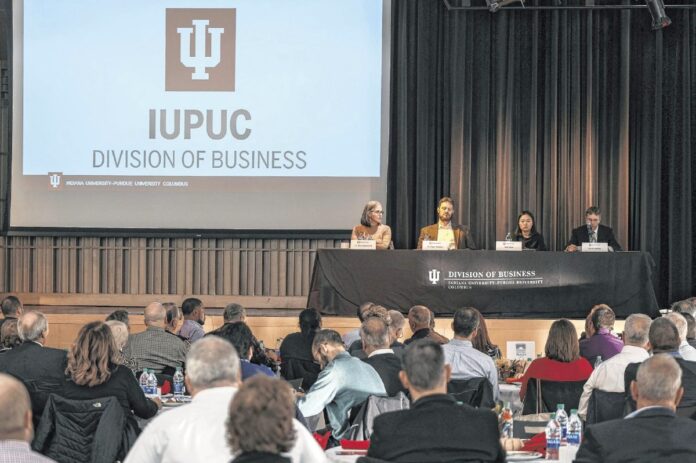

Mafi-Kreft, who was one of four experts who provided an economic forecast to a crowd of around 160 guests during Wednesday’s 2020 Indiana Business Outlook Panel at The Commons, said overall global economic growth next year is expected to be around 3.4% — the slowest growth rate since the financial crisis of 2009.

The projected slowdown, she said, is largely due to several trade disputes, including trade tensions between the United States and China.

[sc:text-divider text-divider-title=”Story continues below gallery” ]Click here to purchase photos from this gallery

The ongoing trade disputes could create further uncertainty for many businesses in Indiana and impact the manufacturing sector and exports, said Sun Yoon, an economic research analyst at the Indiana Business Research Center who provided an economic forecast for the state.

A slowdown in manufacturing could be bad news for a community such as Columbus that is heavily dependent upon manufacturing, exports and Cummins, a global diesel engine and power company and the city’s largest employer, said another panelist, Steven Mohler, a visiting IUPUC professor of management who presented the local economic forecast.

“A continuing decline (in China) coupled with trade disputes reduce the prospects for export-driven businesses, including Cummins, because Cummins relies upon China for growth prospects outside its North American trucking business,” Mohler said. “This poses a threat for the Columbus economy in 2020.”

Last month, Cummins posted a 3% third-quarter sales decline compared to the July-September quarter in 2018, prompting the Fortune 200 company to forecast a 2% decline in revenue in 2019, according to the the company’s third-quarter earnings release.

Lower demand for trucks and construction equipment drove most of the decline, the company said. Sales in North America were flat, while international revenues fell 8%, Mohler said.

The 2020 outlook for Cummins is expected to be flat, with growth in the North American markets offset by declines in the China and India markets, Mohler said.

“We’re manufacturing-heavy in the No. 1 manufacturing state in the country, and when we have a manufacturing contraction, it’s going to hurt our economy more significantly,” said Ryan Brewer, a panelist and IUPUC associate professor of finance. “We’re more cyclical than the country on average, and we’re even more cyclical than the most cyclical state in the country. …However, the economy runs mostly on consumer spending. It’s like 70% of GDP, so it’s not going to affect the rest of the country quite as much as it’s going to affect us.”

However, tariffs and trade disputes are not the only things that could affect Indiana’s economy next year, Yoon said. A tight labor market and low unemployment could make it challenging for employers to fill jobs, Yoon said.

Additionally, continued declines in local residential building permits also could be a bad sign for Columbus, Mohler said.

“Residential housing sales and building permits continue to exhibit weakness for the fourth year in the Columbus area,” Mohler said. “Following a strong fiscal year 2017 for building permits in Columbus, residential building permits declined 35% in 2018 and an additional 20% in fiscal year 2019. Because building permit growth rate is a leading indicator of economic activity, the continuing decline does not constitute a good omen for Columbus.”

Though job creation in Indiana could slow down in 2020, the panel of experts wouldn’t go as far as predicting a recession next year.

“We can’t really quantify the exact impact of the trade war on the manufacturing sector, but we can predict that a trade war will decrease the export of goods to countries and harm employers and employees,” Yoon said.

[sc:pullout-title pullout-title=”Key points” ][sc:pullout-text-begin]

- Global economic growth in 2020 is projected to be 3.4% — the lowest since the financial crisis of 2009

- The overall U.S. economy is projected to grow around 2% in 2020

- Economic output in Indiana is estimated to grow 1.25% in 2020

- Unemployment is projected to remain below 4% at the end of 2020

- By the end of 2020, inflation is expected to be close to the U.S. Federal Reserve’s target of 2%

[sc:pullout-text-end][sc:pullout-title pullout-title=”About the panelists” ][sc:pullout-text-begin]

- Ellie Mafi-Kreft, a clinical associate professor of business economics and public policy at the Kelley School of Business at Indiana University

- Sun Yoon, an economic research analyst at the Indiana Business Research Center

- Ryan Brewer, an associate professor of finance at IUPUC

- Steven Mohler, a visiting professor of management at IUPUC

[sc:pullout-text-end][sc:pullout-title pullout-title=”To learn more” ][sc:pullout-text-begin]

The 2020 Indiana Business Outlook Panel was co-hosted by IUPUC and the Columbus Area Chamber of Commerce.

Detailed 2020 forecasts will be available in the Indiana Business Review in December. The link is ibrc.indiana.edu/ibr.

[sc:pullout-text-end]